- News

- City News

- noida News

- A device commonly used in hotels can steal your ATM card details

Trending

This story is from September 10, 2018

A device commonly used in hotels can steal your ATM card details

Cases related to bank fraud and cloning of ATM cards are on the rise in Noida and Ghaziabad. In Ghaziabad for example, almost 80% of 300 cases received by the cyber cell between January 2017 and August 2018 are related to siphoning of money using ATM skimming techniques or through unauthorised online transactions.

Ghaziabad Police plans to set up a cyber forensic lab in the district to deal with these cases

NOIDA/GHAZIABAD: Cases related to bank fraud and cloning of ATM cards are on the rise in Noida and Ghaziabad. In Ghaziabad for example, almost 80% of 300 cases received by the cyber cell between January 2017 and August 2018 are related to siphoning of money using ATM skimming techniques or through unauthorised online transactions.

Anand Chaudhary (70), a retired district information officer and resident of Omicron 1 in Greater Noida, said he got a series of text messages around midnight July 1, informing him of the withdrawal of Rs 87,000 through his ATM card.

More recently, on August 28, six cases of card cloning in just two days were reported in Noida.

Thereafter, a chip was allegedly found attached to a Punjab National Bank (PNB) ATM in Sanjay Nagar in Ghaziabad on August 14. Bank authorities lodged an FIR against unidentified miscreants. Suspecting it to be a case of ATM skimming, the bank also shut down the kiosk till its technical team gave the green signal. Victims had also suspected that a skimmer had been installed in a PNB ATM at Sector 18 metro station in Noida.

Officials blame easy availability of skimming machines — which are used to copy embedded details of cards in seconds — from online and NCR electronics markets. Reportedly, one such device costs Rs 4,500.

Baljeet Singh, Ghaziabad cyber cell in-charge, said, “Skimming devices, which are small, hard-to-detect devices used by hotels to write and re-write access cards provided to patrons, are being misused by crooks. Cases of ATM card cloning have gone up manifold in the past 4-5 months.” He added victims should immediately report their case to the bank. “If a case is reported on time, the bank is liable to reimburse customers,” Singh added.

Zaheer Khan, SHO, Noida cyber crime cell, said, “The only way we can prevent cloning is by being attentive while swiping cards. It’s advisable not to give cards to the guy at the cash counter. One should swipe their card themselves at a counter to avoid cloning,” Khan added.

Triveni Singh, cyber expert in the UP Police, explained that there are two ways by which ATM cloning is being done by criminals.

Most commonly, ATM cards are getting cloned at restaurants, shops or places where its owner swipes the card and later uses the details to create its copy, Singh said.

“The other way commonly adopted by criminals is to install a duplicate slot in the ATM machine which has an enabled skimmer that reads details of cards. For the pin, a key mapper is placed under the keyboard of an ATM,” Singh added.

He said an ATM’s CCTV cameras store footage for 90 days. “Criminals wait till the CCTV erases footage showing them entering an ATM booth, then carry out multiple transactions either from an ATM located far away, or from different ATMs, to keep the crime untraceable,” said Triveni.

Ghaziabad lead district bank manager S N Mishra emphasised that customers need to remain alert. “Two steps which customers could take to safeguard their accounts are hiding their CVV number using a permanent marker, and by not sharing the one-time password (OTP) with anyone,” Mishra added.

Ghaziabad Police plans to set up a cyber forensic lab in the district to deal with these cases. SSP Vaibhav Krishna accepted that a large number of people are visiting police stations with cases of fraud. “The department is planning to set up a cyber forensic lab to deal with such cases,” Krishna added.

But over the past few months, several people have been cheated of their money. Shambhavi, who lives in Noida Sector 20 and works as an engineer at Sector 16, complained of Rs 24,000 getting debited from her account on the ni ght of August 27.

On the same day, Sector 45 resident Danveer, a guard at a company based in Sector 15, reported a theft of Rs 25,000 through his ATM card, which was with him.

Earlier, in June this year, a 21-year-old LLB student from Raj Nagar area in Ghaziabad, Dhruv Chopra, lost Rs 2.10 lakh to a foreign university, and another Rs 10,000 through a mobile wallet application.

Anand Chaudhary (70), a retired district information officer and resident of Omicron 1 in Greater Noida, said he got a series of text messages around midnight July 1, informing him of the withdrawal of Rs 87,000 through his ATM card.

More recently, on August 28, six cases of card cloning in just two days were reported in Noida.

One of them, Greater Noida resident Shubra Banerjee, received a series of SMSes saying Rs 28,000 been withdrawn using her ATM card, which was with her in the primary school at Harola village in Sector 5 where she teaches. She alerted Sector 6 police station, who forwarded the case to its cyber cell.

Thereafter, a chip was allegedly found attached to a Punjab National Bank (PNB) ATM in Sanjay Nagar in Ghaziabad on August 14. Bank authorities lodged an FIR against unidentified miscreants. Suspecting it to be a case of ATM skimming, the bank also shut down the kiosk till its technical team gave the green signal. Victims had also suspected that a skimmer had been installed in a PNB ATM at Sector 18 metro station in Noida.

Officials blame easy availability of skimming machines — which are used to copy embedded details of cards in seconds — from online and NCR electronics markets. Reportedly, one such device costs Rs 4,500.

Baljeet Singh, Ghaziabad cyber cell in-charge, said, “Skimming devices, which are small, hard-to-detect devices used by hotels to write and re-write access cards provided to patrons, are being misused by crooks. Cases of ATM card cloning have gone up manifold in the past 4-5 months.” He added victims should immediately report their case to the bank. “If a case is reported on time, the bank is liable to reimburse customers,” Singh added.

Zaheer Khan, SHO, Noida cyber crime cell, said, “The only way we can prevent cloning is by being attentive while swiping cards. It’s advisable not to give cards to the guy at the cash counter. One should swipe their card themselves at a counter to avoid cloning,” Khan added.

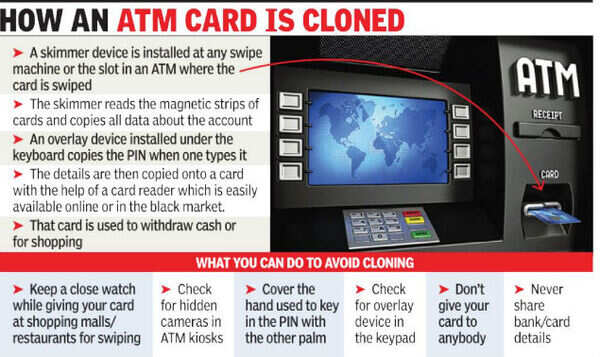

Triveni Singh, cyber expert in the UP Police, explained that there are two ways by which ATM cloning is being done by criminals.

Most commonly, ATM cards are getting cloned at restaurants, shops or places where its owner swipes the card and later uses the details to create its copy, Singh said.

“The other way commonly adopted by criminals is to install a duplicate slot in the ATM machine which has an enabled skimmer that reads details of cards. For the pin, a key mapper is placed under the keyboard of an ATM,” Singh added.

He said an ATM’s CCTV cameras store footage for 90 days. “Criminals wait till the CCTV erases footage showing them entering an ATM booth, then carry out multiple transactions either from an ATM located far away, or from different ATMs, to keep the crime untraceable,” said Triveni.

Ghaziabad lead district bank manager S N Mishra emphasised that customers need to remain alert. “Two steps which customers could take to safeguard their accounts are hiding their CVV number using a permanent marker, and by not sharing the one-time password (OTP) with anyone,” Mishra added.

Ghaziabad Police plans to set up a cyber forensic lab in the district to deal with these cases. SSP Vaibhav Krishna accepted that a large number of people are visiting police stations with cases of fraud. “The department is planning to set up a cyber forensic lab to deal with such cases,” Krishna added.

But over the past few months, several people have been cheated of their money. Shambhavi, who lives in Noida Sector 20 and works as an engineer at Sector 16, complained of Rs 24,000 getting debited from her account on the ni ght of August 27.

On the same day, Sector 45 resident Danveer, a guard at a company based in Sector 15, reported a theft of Rs 25,000 through his ATM card, which was with him.

Earlier, in June this year, a 21-year-old LLB student from Raj Nagar area in Ghaziabad, Dhruv Chopra, lost Rs 2.10 lakh to a foreign university, and another Rs 10,000 through a mobile wallet application.

End of Article

FOLLOW US ON SOCIAL MEDIA